Economics_RS Class 21

A BRIEF OVERVIEW OF THE PREVIOUS CLASS AND UPSC PAPER DISCUSSION (05:01 PM)

QUESTION (05:15 PM)

- Question- Public expenditure management is a challenge to the Government of India in the context of Budget making during the post-liberalization period. Clarify it (15 marks/ 250 words)

- Approach:- Balance of spending between infrastructure spending and Welfare.

- The government tax/GDP ratio did not increase despite the tax reforms.

- 80th CAA 2000 made corporate taxes part of the divisible pool, and thus centre will have less money in hand.

- 10th Finance Commission and 14th Finance Commission increased the devolution of funds to the state from a divisible pool.

- The government also had to maintain a "Rule-based fiscal policy" which constrained the Government from its resources.

- After LPG, the Indian economy became more vulnerable to external shocks this was evident during the Global Financial crisis 2007-08.

- Trade wars etc.

- FRBM Amendments in the format of N K Singh committee recommendations specifically targeted to reduce the Debt/ GDP ratio.

- Few areas where there was a challenge

- The government is facing the challenge of Off-budget financing. [* The separate legal entity such as FCI, IOCL, ONGC, etc will borrow on behalf of the government and do the expenditure. This borrowing will not be shown in the Budget. Example- Oil bonds]

- The main intention of FRBM was not considered i.e. Reallocating the expenditure from Revenue to Capital expenditure. The government was only focusing on reducing the FD.

- Positives done by Government in reducing the Deficit

- The government also started focusing on Strategic Disinvestment.

- [* In disinvestment there are two things

- a) Minority sale- Selling 5%, 10%, etc

- b) Strategic sale- Selling more than or equal to 50%. ]

- Government is more focused on Fiscal consolidation through

- a) Government started focusing on schemes like the Give it Up campaign in LPG cylinders

- b) Government starting to use "Nudge Techniques" i.e. slight push to bring appropriate behaviour (This is a part of behavioural economics which deals with changing consumer behaviour). Example- Selfie with Daughter campaign.

- Fiscal discipline- Not spending money on unwanted activity and strictly focusing on reducing public debt.

- Inflation targeting- The government came up with a target of 4% +/- 2%. If inflation is under control then the government will pay less subsidy.

DOCUMENTS REQUIRED UNDER FRBM (05:41 PM)

- Medium Term Fiscal policy statement

- Macroeconomic Framework Statement

- Fiscal policy strategy statement

- Medium-term expenditure framework statement (MTEF)- A 3-year rolling target for the expenditure indicators with a specification of underlying assumptions and risk involved. The objective of MTEF is to provide closer integration between Budget and FRBM statements.

FRBM AMENDMENTS (05:47 PM)

- FRBM targets to be achieved by 2015 i.e FRBM amendment Act 2012

- Eliminate RD by March 31st, 2015 and the minimum Annual reduction is 0.5% of the GDP

- Fiscal deficit target- To be reduced to 3% of GDP by March 31st, 2015. Minimum annual reduction of 0.3% of GDP

- FRBM targets to be achieved by 2018 i.e FRBM amendment Act 2015

- RD is to be eliminated by March 31st, 2018.

- Fiscal deficit target- should be reduced to 3% of GDP by March 31st, 2018.

FRBM REVIEW COMMITTEE- N K SINGH (05:50 PM)

- [* Effective capital expenditure= Capital expenditure of the government + Money given to states for capital expenditure]

- Budget 2023-24 at a glance

- The committee recommended that the government should target the FD of 3% of GDP in the years up to March 31st, 2020, reduce it to 2.8% in 2020-21, and further to 2.5% by 2023.

- The committee suggested using Debt as the primary target for Fiscal policy. The government's debt/ GDP ratio should be reduced to 60% with a 40% limit for the centre and 20% for the state.

- RD target- RD should be reduced to 0.8% of GDP by March 31st, 2023 with a minimum annual reduction target of 0.5% of GDP

- FD target- FD should be reduced to 2.5% of GDP by March 31st, 2023 with a minimum annual reduction target of 0.3% of GDP

- Escape clause (06:05 PM)

- An escape clause under the FRBM Act details a set of events in which the central government can deviate from FD targets. In 2017, the N K Singh committee said that the exceptional circumstances mentioned in the FRBM Act 2003 were defined opaquely and were liable to misuse.

- In 2018, FRBM Act was amended to specify 3 conditions upon which an escape clause can be invoked

- 1) During national security issues, Acts of war, Calamities of national proportion, and collapse of agriculture severely affected farm outputs and income.

- 2) Structural reforms in the economy with unanticipated fiscal implications

- 3) A sharp decline in Real output growth of at least 3 percentage points below the average of the previous 4 quarters

- The FRBM amendments also mentioned that the deviation from the FD targets must not exceed 0.5 percentage points in a year.

- Note- The term escape clause is not specifically used in the FRBM Act 2003 but is only visible in the FRBM review committee report.

CHALLENGES OF THE GOVERNMENT (06:12 PM)

- In the recent past, there was an increase in off-budget financing of the government (The borrowings are not visible in the government's budget).

- After 2018, the government started focusing only on FD neglecting the Revenue Deficit target.

MEASURES TAKEN BY THE GOVERNMENT TO ENSURE FISCAL CONSOLIDATION (06:15 PM)

- Implementation of GST, thereby increasing the tax base and tax efficiency.

- Focus on securities transaction tax due to an increase in tax avoidance with respect to capital gains tax.

- Strategic disinvestment- Along with minority stake sales, the government also focussed on strategic disinvestment i.e. disinvesting above 50% to improve efficiency and reduce deficits.

- Increase in coordination between monetary policy and Fiscal policy of the government. [* Focus on inflation targeting]

- The government started reducing public debt.

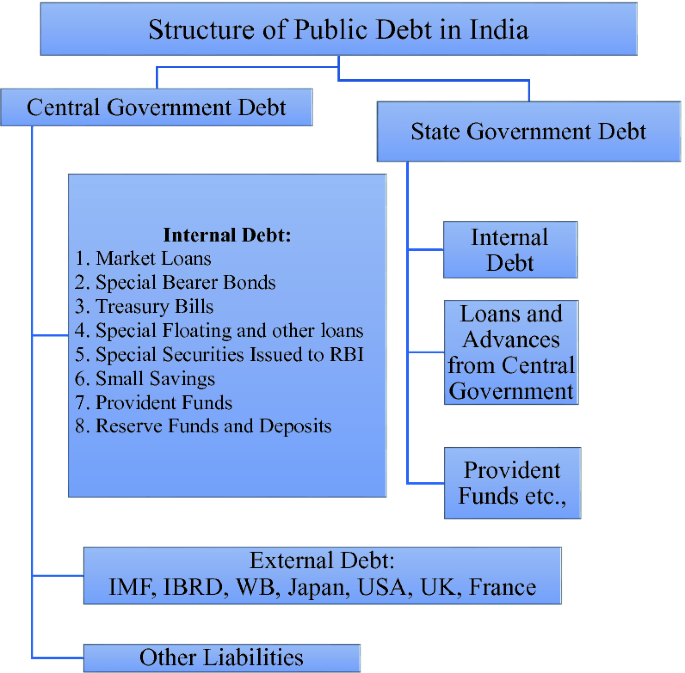

- Public debt

- It is the total amount borrowed by the government of the country when the government's revenue from taxes and other sources falls short of its pending requirements.

- In India, public debt includes the total liabilities of the Union government that have to be paid from the consolidated fund of India. (Article 292)

- Public debt can be further classified into Internal debt and external debt.

- Internal debt is classified into Marketable and Non-marketable securities.

- Marketable government securities include G-secs and Treasury Bills issued through auction. Non-marketable securities include Intermediate Treasury Bills issued to state governments and special securities issued to national small savings funds etc.

- Sometimes public debts refer to the Overall liabilities of the central and state governments however Union government clearly distinguishes its debt liabilities from those of the states.

- The overall liabilities of the centre and state is termed "Consolidated General Government Debt".

- The internal debt comprises loans raised in the open market including borrowings through treasury Bills, commercial banks, and other investors. It also includes non-interest-bearing rupee securities issued to international financial institutions.

- The part of the nation's debt that is borrowed from foreign lenders such as commercial banks, governments, and international financial institutions is referred to as its external debt. These loans must typically be repaid in the currency used to make the loan plus any applicable interest.

- Government's Debt/ GDP ratio will determine the capacity of the government to finance its debt.

- Finance Minister said, that we should focus on external debt to prevent "crowding out" of the Private sector.

- Government can finance the deficit through

- a) Internal sources- Loan from RBI, RBI minting money and giving it to Government, Market instruments such as dated securities or T-Bills, Non-marketable instruments such as Treasury bills issued specifically to states.

- Challenges of internal financing- Crowding out of the private sector, Inflationary tendency.

- [ * When India issues bonds in other countries in foreign currency and investors are subscribing to the bonds then the interest given to them will also be in Foreign currency. The risk for the Indian company is currency exchange risk. ]

- [ ** Suppose while issuing the bond 1$= 50Rs, after one year, the rupee depreciated to 100rs then the Interest which is paid in Dollar becomes costly and also the principal amount paid will also becomes costly. ]

- [ ** Masala Bonds are Ruppee-denominated bonds issued in another country. When investors have to buy these bonds they have to make payments in Ruppes and they will also receive interest in Ruppes. The risk which earlier was on the Indian company now shifted to the investor. ]

- b) External sources-

- Public debt management (07:09 PM)

- Public debt management is the process of establishing and executing a strategy for managing the government's debt to raise the required amount of funding. In 2015 the creation of a statutory body called public debt management agency was envisaged in India.

- As RBI sets interest rates and conducted the sale and purchase of government Bonds, it raised issues of conflicts between the regulatory and debt management functions of the RBI.

- A temporary Public debt management cell was arranged with the following advisory functions to the government

- a) Monitor cash balances of the government, improve cash forecasting, and promote efficient cash management practices.

- b) Advise on matters related to investment and capital market operations.

- c) Undertake research work related to new product development, Risk management, debt sustainability assessment etc

- d) Develop a database system for collecting and maintaining a comprehensive database of the government of India's liabilities on a real-time basis

- e) Carry out preparatory work for independent PDMA

INFRASTRUCTURE & INFRASTRUCTURE FINANCING (07:17 PM)

- Structure of the topic

- What is infrastructure

- Need for Infrastructure

- Different types of infrastructure

- Challenges of infrastructure financing

- Measures taken by the government with respect to infrastructure financing

- New policies with respect to infrastructure- National infrastructure Pipeline, National monetization pipeline, National logistics policy, PM Gati Shakti.

- Importance of public-private partnership with respect to infrastructure development

- Different types of PPP model

- New PPP models- Hybrid Annuity model and Swiss challenge

- Vijay Kelkat committee recommendations on PPP.

- Positives and Negatives of PPP

INFRASTRUCTURE (07:23 PM)

- Benefits of infrastructure development

- Infrastructure development will lead to positive externalities such as social infrastructure

- Infrastructure development will lead to a "crowd-in" of private investment

- Infrastructure development will lead to the creation of jobs, Inclusive Development, Economic Growth, reducing poverty, and Multiplier effect.

- Challenges of infrastructure financing

- As per the 11th Five-year plan, 45% of the fund was coming from the government budget and 55% was coming from the debt and equity. Debt and equity were financed through the banks.

- Banks faced the Problem of "Asset-liability mismatch"

- The fiscal burden of the government increased as Government followed the rule-based policy

- The bond market is still at a nascent stage, even municipalities can issue bonds and raise funds, but the market is not deep enough.

- Legal and procedural issues- land acquisition issues, stalled projects

- Regulatory cholesterol- The government is excessively controlling the sector.

- Insurance and pension fund companies are better enough to invest in infrastructure as they have a long gestation period, but IRDA guidelines restrict them to invest in Infrastructure sectors.

- After 2008, the ECB movement also reduced.

- Mechanisms to boost infrastructure

- National infrastructure pipeline- Greenfield + Brown field; 111 lakh crore; 9000+ projects

- National monetization pipeline-

- Other methods

- PPP- Public-Private Partnership- Risk sharing mechanism

- Viability Gap Funding- The government will spend 20% of capital cost and another 20% will come from sponsoring authority. This is mainly for economic projects.

- Infrastructure debt fund company- Group of financial companies can come together and set up an infrastructure debt fund company. They fund long-term infrastructure projects. The issuer will distribute dividends to the subscribers of the debt from the interest paid.

- There was a tax collected from a source which was called "Withholding tax". Later the withholding tax was reduced from 20% to 5% so that more money will be available to the investor.

- Important points

- It is a set of basic physical systems of a business, region, or nation i.e. fundamental in the sustainable functionality of the very entity itself i.e. these are basic facilities necessary for the proper functioning of an economy and society.

- Different types of infrastructure

- a) Social infrastructure- These include housing, health, education etc.

- b) Economic infrastructure- This refers to a set of fundamental structures which support the process of production and distribution in an economy. Examples- Transportation, power, communication, etc.

- c) Soft infrastructure - it refers to infrastructure that comprises institutions that help in maintaining the economy. They include the delivery of certain essential services to the population. Human capital usually forms the main component of this infrastructure. Examples- Healthcare systems, education systems, financial systems etc

- d) Hard infrastructure- It refers to physical systems that are necessary to run the Roads, highways, bridges, etc

The topic for the next class:- Infrastructures financing and Infrastructure model.